Our Profit-Share has Grown

After another Profit-Share assignment our Members total Profit-Share Account balance has grown yet again.

Total Profit-Share Account Pool

IT PAYS TO HAVE A PPS MUTUAL POLICY

Every Member is entitled to a share in the profits of the insurance that they buy. And this year is the seventh consecutive year they’ve been rewarded with a profit share assignment.

Total number of

PPS Mutual Members

as of 30 September 2023:

10,248

Total Profit-Share

Assignment for 2023:

$2,220,391

Total Profit-Share

Account

Pool:

$7,900,000

The Profit-Share Pool has more than TRIPLED over the last 3 years

$2.4m

in 2020

$7.9M

in 2023

One Member has

accrued over $30,000 in

Profit-Share

Members have been

rewarded with a

Profit-Share every

year since we

started in 2016

348 Members

have accrued

more than

$3,000 in

Profit-Share

37 Members have

accrued more than

$10,000 in Profit-Share

And one Member has

accrued $14,000 in

Profit-Share despite

only paying one

premium before

claiming.

BUSY REWARDING MEMBERS

Our members have been consistently rewarded with profit share assignments and interest on their profit share accounts.

% of profit assigned to member accounts |

Interest earned on member accounts |

|||

| 2017 | 8.0% | + | NA | |

| 2018 | 7.0% | + | 2.0% | |

| 2019 | 7.0% | + | 4.0% | |

| 2020 | 7.0% | + | 4.5% | |

| 2021 | 6.0% | + | 2.75% | |

| 2022 | 3.5% | + | 1.75% | |

| 2023 | 3.5% | + | 3.9% | |

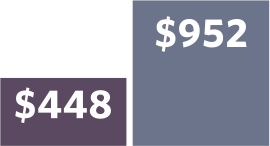

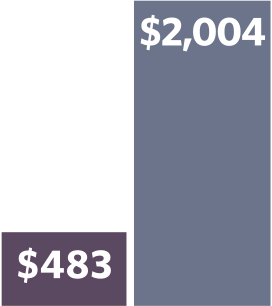

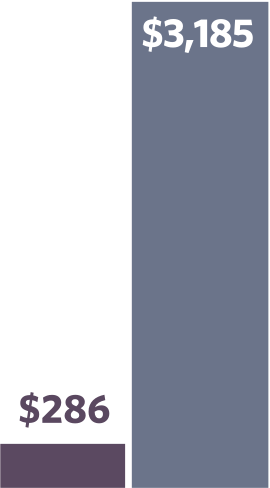

PROFIT-SHARE FOR MEMBERS

Members Profit-Share Account Balances have increased every year since our inception.

Profit-Share Assignment

Profit-Share Assignment  Profit-Share Account Balance

Profit-Share Account Balance

These figures are illustrative only, showing assignments and balances based on the actual premium dollar amount that a hypothetical PPSM Member who paid an initial annual premium of $6,168 when joining PPSM in 2016 (being an approximate average total premium, with indexation and plan fees applying in line with our rates since 2016).

LOWER LAPSE RATES

Thanks to our consistent profit-share assignments, once members join us they very rarely leave.

PPS Mutual

lapse rate

4.3%

Industry average

lapse rate

15%

Source: NMG Retail Advice Channel Risk Distribution Monitor Q2 2023.

PPS Mutual and the profit share offering have been a breath of fresh air in the life insurance industry. It provides great peace of mind as an adviser recommending their products that the business is centred around member service/benefits. Every other insurer in the market has the competing interests of delivering shareholder returns and/or client service. These interests aren’t always aligned and we know which comes first in shareholder owned companies. It will be a great pleasure when clients get to the end of their insurance journey being able to return their profit share accounts.

*Details of the profit-share plan (including accessing a profit-share account) are available in the PDS – speak to your adviser about any questions.