NEWS August 21, 2025

Cover confusion is costly: Are your clients at risk?

If your clients are confused about what their life insurance actually covers, they’re not alone.

In today’s cost-conscious environment, Australians are scrutinising every dollar – meaning insurance is moving from a “set and forget” item to a live conversation.

NobleOak research shows that 60% now hold some form of life insurance or income protection – up from 55% last year and well above the three-year average of 51%.

But while cover uptake is rising, comprehension remains low. Many Australians believe the default policy in their super will support them in a crisis – but would it actually pay out if they were off work for six months? Or if they were diagnosed with a serious illness?

That question is becoming more urgent – especially when it comes to mental health.

According to Council of Australian Life Insurers (CALI), mental health conditions are now the leading cause of TPD claims – accounting for nearly one in three payouts.

In 2024 alone, insurers paid over $2.2 billion in mental-health-related retail claims – almost double the figure from five years ago. Income protection claims linked to mental health now total $887 million, representing one in five of all such claims.

CALI’s data reflects a growing health concern – but it also raises deeper questions about the resilience of group insurance, where definitions and coverage can shift in response to rising claims.

Group insurance is not guaranteed renewable, meaning definitions and benefits can change from year to year.

This is especially troubling in the context of mental health, where cover can be capped, narrowed, or removed altogether in future policy periods – leaving members vulnerable when they need protection most. These concerns have been echoed by Super Consumers Australia, which has called on super funds to make the claims process “fairer, faster, and more compassionate, particularly for people with mental health conditions”.

All of this highlights two uncomfortable truths:

- The risk of a claim is higher than many clients assume – especially for mental health.

- The quality of cover matters just as much as having cover at all.

Clients relying on default insurance often assume they’re adequately covered – until a claim proves otherwise. That’s where skilled risk advice becomes invaluable.

The adviser advantage in a confused market

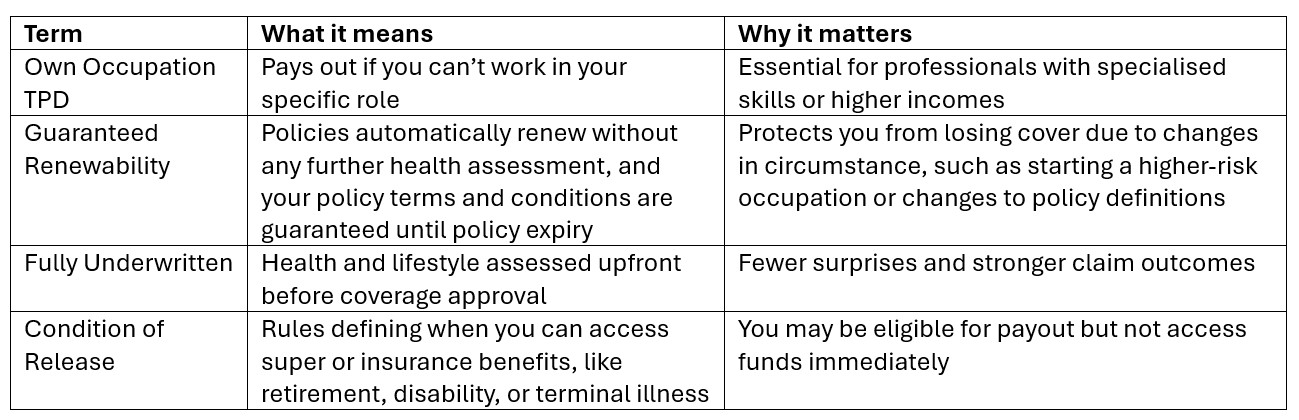

NobleOak research shows only 30% of Australians with life cover truly understand what a fully underwritten policy means. Many struggle with key terms and phrases that often decide whether a claim is paid or denied, such as:

Now more than ever, advisers have an opportunity to demonstrate tangible value by helping clients navigate the complexities of their insurance cover – particularly the differences between group and retail options.

Group insurance may be affordable and convenient, but it often lacks critical features like tailored benefit periods, robust definitions, or full underwriting.

Retail cover, on the other hand, is designed to reflect a client’s occupation, health history, lifestyle, and financial objectives – offering greater certainty at claim time through stronger definitions and guaranteed renewability.

But clients rarely see these distinctions on their own – that clarity comes from you.

For many, the most value comes from a hybrid approach: combining group and retail cover to maximise flexibility and protection. But without advice, they won’t know what’s possible – let alone optimal.

Reviews are the most underrated part of risk advice

Your value doesn’t stop at policy selection. The real leverage comes from the moments clients don’t see coming – life changes, new liabilities and claimable events hiding in plain sight.

Routine reviews often reveal trauma or income protection claims that clients didn’t know they were eligible for. They also uncover mismatches: policies written for a career they’ve since left, a family structure that’s changed, or income that’s outpaced their benefits.

While clients are increasingly proactive on tax, investments and superannuation, insurance still lingers in the “too-hard basket”.

That’s why regular insurance reviews should be part of every comprehensive financial plan. Frame these check-ins around practical questions that clients understand:

- If you couldn’t work for three-to-six months, how would your finances hold up?

- Does your current cover still align with the income, liabilities, and life stage we’ve planned for?

- Do you know if your super policy would cover you for a mental health claim?

With household budgets tightening, clients may be tempted to reduce or drop insurance.

But as every adviser knows, the true cost of insufficient cover only reveals itself at claim time. A well-timed review can uncover claimable events, close protection gaps, or prevent future disappointment.

One conversation could be the difference between an overlooked gap and a claim that changes a life.