ON

CLOUD

NINE

After 9 years of successive Profit-Share growth our Members are on top of the world.

Our Profit-Share pool is up 31% on last year and now stands at

$15M

Total Profit-Share Assignment

for 2025 is

$3.8M

a 24% increase from last year.

It really does pay to have a PPS Mutual policy. Every Member is entitled to a share in the profits of the insurance they buy. And every year since we started the Profit-Share pool has grown.

IT REALLY PAYS TO HAVE A

PPS MUTUAL POLICY.

17

Members have

accrued over

$20,000 in

Profit-Share

390

Members have accrued

more than $5,000 in

Profit-Share

101

Members have accrued

more than $10,000 in

Profit-Share

Members have

been rewarded with a

Profit-Share every year

since we started in

2016

PUTTING PROFITS IN MEMBER’S POCKETS

Many Members have started withdrawing funds from their Profit-Share Accounts

43

Members have now

accessed over

$157,000

12

Members have now

accessed between

$5,000 – $10,000

2

Members

have accessed

over $10,000

29

Members have now

accessed up to

$5,000

REWARDING MEMBERS EVERY YEAR SINCE LAUNCH

Every year since launch Members have been rewarded with Profit-Share assignments. We assign profit in two ways – as a % of premiums and as an interest on the Profit-Share Account.

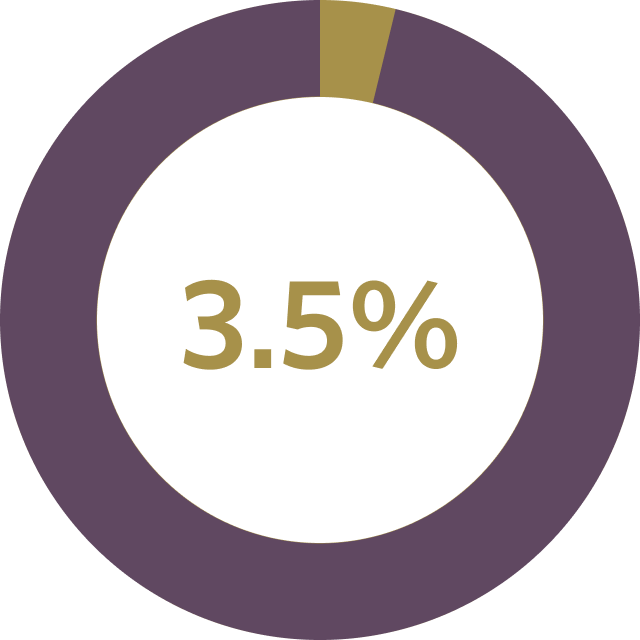

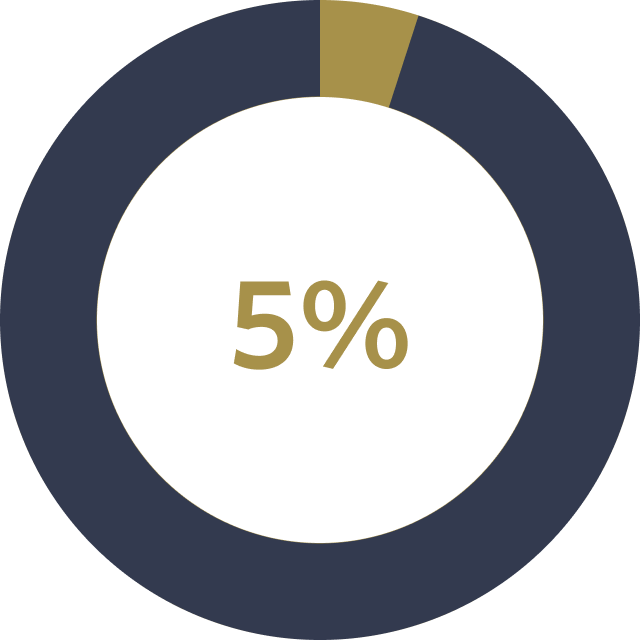

This year PPS Mutual are declaring the below Profit-Share Rates for the 2025 Financial Year:

of Premiums in relation to the 2025 financial year

of the Opening Balance of

their Profit-Share Account

AND OUR ADVISERS ARE OVER THE MOON TOO…

By only providing specialist life insurance for professionals, and sharing profits with our Members, we’re generating more sustainable, higher-value business for our accredited advisers.

HIGHER-VALUE BUSINESS

Our proposition attracts high earning professionals in need of higher sums assured.

31

Advisers have more than $100K

in total client Profit-Share

Account balances.

7

Advice firms have over $500K

in total client Profit-Share

Account balances.

3

Advice firms have over $1m

in total client Profit-Share

Account balances.

HIGHER CLIENT RETENTION

Our proposition fosters strong, long-term relationships between clients and advisers.

PPS Mutual annual lapse rate:

5.1%p.a.*

Industry average annual lapse rate:

14.1%p.a.*

WHAT OUR ADVISERS ARE SAYING

Hear from some of our accredited advisers about what it’s like to work with PPS Mutual.