INSIGHT September 01, 2021

Will APRA Income Protection changes put Business Expenses cover centre stage?

October 2021 will see a significant refresh of income protection offerings across the market, in line with new APRA requirements.

Amongst the changes is the capping of income replacement ratios, which will see maximum insurable benefits decrease from 75% to 70% of income.

Whilst this has elicited concern in some quarters, I do believe the core proposition of – and need for – income protection remains very strong, and that, for professional clients in particular, 70% of income as an insured benefit remains a vastly superior scenario compared to the alternative – relying on savings or Centrelink benefits, or financial help from family and friends.

Whilst we are yet to see these changes – and their longer-term impact on premium rates – play out in the market, one outcome I am certain of is a renewed appreciation of the role for Business Expenses cover.

Business expenses cover will become even more critical.

Business Expenses could almost be called the ‘forgotten cover’; considering that many income protection policies are sold to self-employed business owners, I have always been surprised at how few of these policies are sold in conjunction with a Business Expenses add-on.

As many business owning IP claimants find to their detriment, fixed business expenses continue even when their income stops. And, contrary to what some business owners believe, business interruption insurance doesn’t cover this scenario at all.

Wages, rent, utilities, equipment hire costs – they all need to be paid even when the business owner can’t work. Without Business Expenses insurance – which can cover up to 100% of eligible fixed business expenses – claimants are forced to dip into their income protection benefits or savings to meet those continuing expenses. Not doing so would put them of risk of being evicted, seeing equipment repossessed, losing valued staff and even their clients. Ultimately, they could be forced to close their doors.

With maximum monthly benefits set at a maximum of 70%, claimants who are forced to put some of their claim benefits towards propping up their business will have even less to pay for their own day to day living expenses (including rent/mortgage, food, car loans, school fees, and credit card bills just to name a few).

You could say that without Business Expenses cover, the benefits of income protection are eroded, potentially significantly.

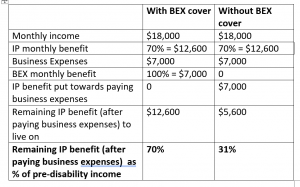

Imagine a doctor who owns their own practice, generating an income of $25,000 per month, from which comes $7,000 in business expenses, including the wages for an office assistant, rent, phone, internet, and equipment leasing. The remaining $18,000 is drawn as a monthly salary.

A cycling accident sees them break their arm in several places, leaving them unable to work for around three months. The scenarios with and without business expenses cover are shown below.

Without Business Expenses cover, the claimant effectively has less than a third of their normal income to live off once they have paid for ongoing business costs.

You can imagine how challenging that might be.

Business Expenses Cover is an essential, easy to add, partner for income protection cover.

For clients with fixed business expenses, it’s hard to mount an argument against Business Expenses cover. It’s an easy add on at time of application, and just like income protection, premiums are 100% tax deductible.

Also, like income protection, Business Expenses cover will pay a partial business expense, in the event the claimant comes back to work in a reduced capacity, generating a reduced business income. This allows them further peace of mind while they gradually rehabilitate and return to full time work.

At PPS Mutual we are particularly proud of our Business Expenses Insurance offering, which has been rated #1 by IRESS, and includes top rated features such as the Payment Extension Benefit. This benefit extends the Benefit Period (whilst the Member continues to meet the claim criteria) until 12 times the Monthly Benefit has been paid. This provides additional peace of mind while your client gradually rehabilitates and returns to full time work.

Other features include:

- it cover’s both capital and interest on a loan

- we cover the net cost of a locum and there is a Day 1 accident option available.

- It also has several special features tailored to the unique needs of professionals. One of these, the Indexation for Professionals Benefit, allows benefits to be increased by the greater of the increase in the Professional Earnings Index or CPI, without underwriting. We find the Professional Earnings Index is a more meaningful and accurate reflection of earnings trends in professional occupations, allowing benefits to better keep pace with income increases.

In light of the APRA changes, ensuring your client’s protection works as hard as possible will obviously become even more crucial, which is why Business Expenses cover could be about to have a well-deserved moment in the sun.