NEWS August 19, 2020

Study Reveals Delayed Costs From Front Loaded Discounts

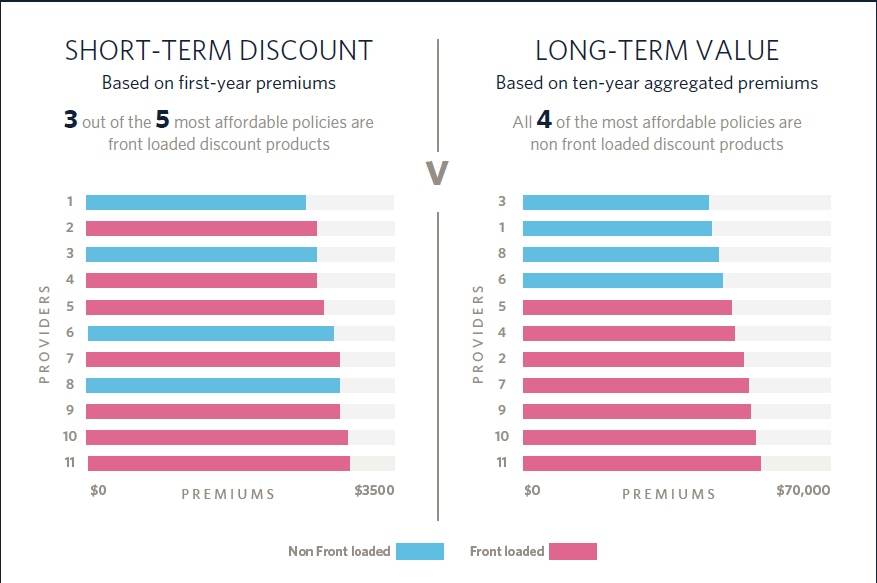

New research suggests that while new life risk policies with front loaded discounts can increase affordability in first-year premiums, they can be more costly to consumers over the medium-to-long term, especially for life, TPD and trauma.

The research, commissioned by PPS Mutual and undertaken by actuarial consultants Rice Warner, reviews front loaded discounts prevalent in Australia’s retail life insurance market and the longer term impacts of the practice.

It shows that front loaded discount policies with stepped premiums have on average lower premiums in the first policy year, but higher premiums from the third policy year onwards (click here for the full report).

PPS Mutual chief executive Michael Pillemer says in a statement that the findings of the report confirm his belief that front loaded discounts represent poor consumer practices that should be fixed by the retail life risk insurance sector in Australia.

“Increasingly, in a bid to secure market share, the retail insurance industry has adopted initial short term discounts for new business premiums. The research demonstrates how over five to 20 years, policies with front loaded discounts have significantly higher premium increases relative to the first policy year,” he says.

He cites one example where customers of one insurer offering a 25 percent up-front discount could face increases of 50 percent plus in premiums in the second year once you also take into account age-based increases and indexation.

“The effect that these sharp premium increases have psychologically on a client, and the increased likelihood the client will lapse as a result, should not be underestimated,” he says.

Pillemer contends that front loaded discounts are likely to increase lapses for three reasons. Firstly, they encourage customers to switch to a policy with a lower first year premium in the first instance. Secondly, they mostly have higher premiums on average from the third policy year onwards. Lastly, they will also differ even more markedly to new business quotes where the first year discount still applies.

The report also shows the difference between non-true level premiums and true-level premiums in medium and long-term cost. It says that typically, the premiums are very similar for the first five policy years, but by the eleventh policy year the most affordable non-true level premium is higher than the least affordable true level premium.

“In 2019, life insurers lost $1.3bn, lapse rates for traditional life insurers remained stubbornly high at about 17 percent and policyholders have had to endure significant and repeated increases in premiums (in some cases by more than 35 percent).

“We believe that there has never been a more important time to reassess past dynamics of the sector, and work towards building a strong and sustainable insurance industry for all Australians.”

Pillemer told Riskinfo that the company undertook the research because it had been concerned about insurers’ chasing market share and had felt front loaded discounts were emblematic of what needs to be fixed by the industry today.

He says the life industry has handled the Covid crisis so well and now is a great opportunity for a reset. “Now is the time to take a step back… and to focus on the long term.”

He sees this very much as a product problem, not an advice problem, and says that the blame for front loaded discounts must not be allowed to go back to advisers.

“Financial advisers have such an important role to play, particularly in building consumer trust. And they can see how the initial upfront benefit is not in the long term benefit of the consumer.”

Asked whether other insurers would heed the report, Pillemer was hopeful they would when they took a look at the research.

As to advisers, he is hoping advisers will also look at the research and will stop offering these sort of products to their clients. He says advisers need to push back with insurers as all too often advisers bear the brunt of any bad outcomes.