INSIGHT June 16, 2019

Royal Commission Highlights Value of Mutual

Damning revelations of corporate misconduct from the Hayne Royal Commission have mainly been driven by institutions putting shareholders ahead of customers. In this context, the mutual model portrays a radical reappraisal of how life insurance can better serve consumers in the Australian market.

One of the key take-aways from the Commission appears to be that in response to shareholder pressure to consistently increase profits and dividends, many organisations have elevated the desire to make money as their primary goal. In the words of Kenneth Hayne’s Interim Report: “Financial services entities recognised that they sold services and products. Selling became their focus of attention. Too often it [profit maximisation and sales] became the sole focus of attention.”

One of the key take-aways from the Commission appears to be that in response to shareholder pressure to consistently increase profits and dividends, many organisations have elevated the desire to make money as their primary goal. In the words of Kenneth Hayne’s Interim Report: “Financial services entities recognised that they sold services and products. Selling became their focus of attention. Too often it [profit maximisation and sales] became the sole focus of attention.”

In terms of the vertical integration of financial services companies, the Commission also explicitly highlighted its shortfalls: “The one-stop shop has an incentive to promote the owner’s products above others, even where they may not be ideal for the consumer.”

With these corporate scandals now out in the open, the public is rightly demanding higher standards of professional and ethical conduct. Notably, consumers believe they may risk exposing themselves to overpriced products that may not suit their needs or fail to cover them in times of need.

But there is some good news for Australian professionals: not all insurance companies value profit over customer benefit.

Consumers can be confident that when they buy their insurance from a mutual insurance company, their interests will

be put first. The primary reason is that mutuals are owned by policyholders, not shareholders.

That’s a crucial distinction – mutuals look after policyholders interests first by providing products which cater to their needs, rather than selling products solely with profit in mind.

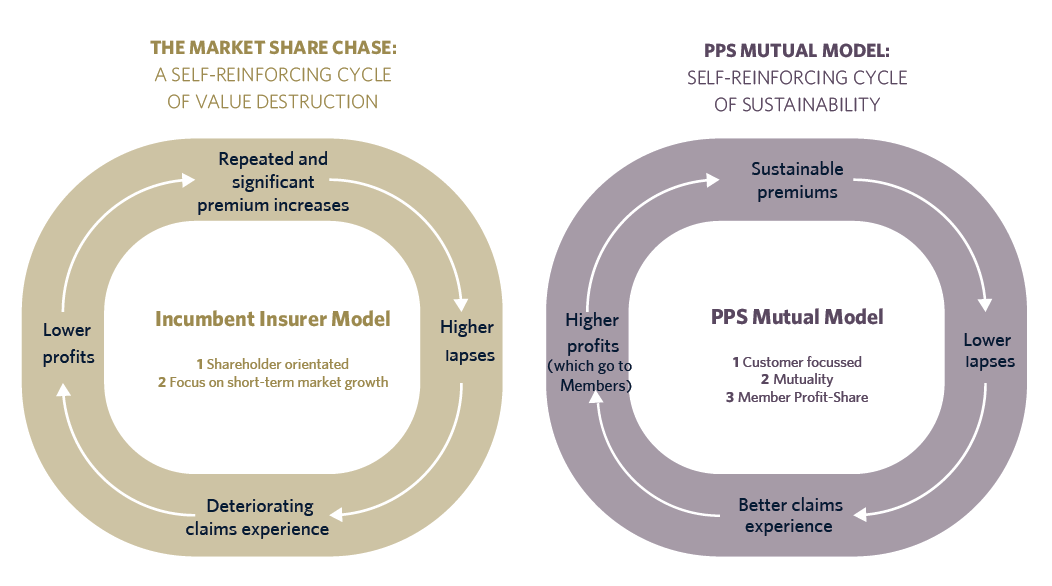

Importantly, profits earned by a mutual insurance company are distributed back to policyholders in the form of lower premiums or profit distributions. This mutual ownership structure, rather than public ownership, encourages mutuals to make decisions that deliver long-term benefits to their members.

Ironically, the focus on clients and the loyalty that ensues leads to enhanced profits in the long-term.

In addition, mutuality delivers a strong foundation on which to offer life insurance products because of the long-term nature of policy coverage. That contrasts to publicly listed insurers where market forces such as a falling share price or narrowing interest-rate margins encourage decision-making that delivers short-term benefits to shareholders over the longer-term needs of policyholders.

The recent demise of AMP Life, once a mutual and the bastion of the life insurance industry, can be traced back to its

demutualisation in 1997.

In Australia, PPS Mutual is strongly differentiated by its mutual ownership structure, its focus on professions like

accountants and its partnerships with high-quality non-aligned financial advisers. In association with the 75-year old PPS in South Africa, PPS Mutual confers the benefits of mutuality to its Australian members.

Each year, PPS Mutual Members are assigned a share of the annual profit generated from the insurance that they buy.

After 10 years’ Membership, policyholders can start to withdraw this money from their Profit-Share account.

So, as the final outcome of the Royal Commission washes out, there is still life left in the insurance sector. Australians can be confident that their needs and interests will always be put first when buying insurance from a mutual.

January 16, 2019